Builder’s Risk Insurance: What It Is and How It Works

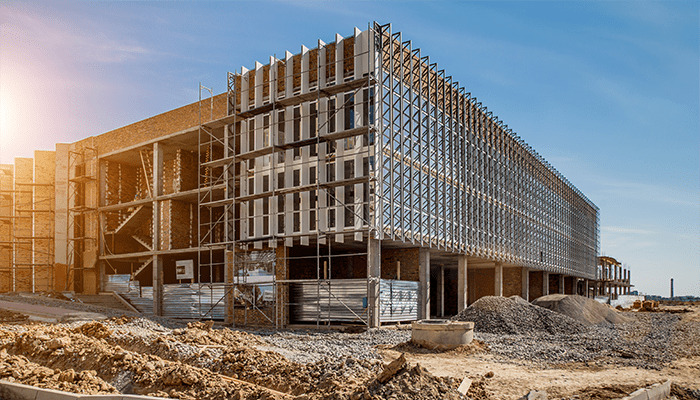

AssuredPartners Construction represents over 21,000 construction clients nationwide, with over 200 construction professionals to serve you. Contact our team to learn more.Builder’s risk insurance is a type of property insurance that covers buildings and structures while they are under construction. This policy is essential for protecting investments from potential risks and losses.

Receive regular updates on safety best practices, as well as tips for minimizing risks within your projects.

One of the primary benefits of builder’s risk insurance is that it provides coverage for damage or loss to the insured property during construction. This includes protection against numerous hazards such as fire, theft, vandalism, and natural disasters like hurricanes and earthquakes. Without builder’s risk insurance, contractors and property owners could face significant financial losses if a construction project is interrupted or damaged due to unforeseen circumstances.

Builders risk insurance can also cover additional expenses incurred as a result of a covered loss, such as debris removal, temporary structures, and project delays. This coverage can help mitigate the financial impact of unexpected events and ensure the project stays on track.

It is important to note that builders risk insurance typically covers the structure under construction, as well as materials and supplies on-site. It may also provide coverage for scaffolding, temporary structures, and equipment used. However, it is essential to review the policy details carefully to understand the specific coverage limits and exclusions.

In the insurance industry, builders risk insurance plays a vital role in managing risk and protecting investments in construction projects. Insurers assess the risk factors associated with a construction project, such as location, project value, and construction methods, to determine the appropriate coverage and premium rates.

Overall, builders risk insurance is critical in providing financial protection and peace of mind for contractors, property owners, and developers. By understanding the importance of builder’s risk insurance and its benefits, stakeholders in the construction industry can effectively manage risks and ensure the success of their projects.

Featured News & Insights

Construction is changing fast, driven by new technology, shaped by a more diverse workforce, and challenged by global pressures. At AssuredPartners, we’re proud to help build what’s next by...

When it comes to builders risk insurance, how you're listed on the policy can make or break your ability to recover key losses. A recent decision by the Eighth Circuit Court of Appeals drives this...

In construction, most things are done with precision and planning. So why are so many contractors still skipping written contracts with their subs? If you’re responsible for your company’s insurance...