Protecting Your Home and Belongings from Hurricane Damage

Hurricane season is a stressful time for many homeowners, especially those living in coastal areas that are prone to severe storms. Hurricanes can cause extensive damage to properties, from roof leaks and broken windows to flooding and mold. It’s important to have the right coverage in place before disaster strikes. We'll explore some of the insurance options you should consider when protecting your home and belongings from hurricane-related losses. Whether you're a new homeowner or a seasoned one, this guide will help you navigate through hurricane season with confidence and peace of mind.

What Should I Consider?

Homeowners insurance typically covers damage caused by wind, hail, lightning, fire and theft. However, there are limitations and exclusions that you should be aware of when it comes to hurricane-related losses. One of the most common exclusions is flood damage, which is not covered by standard homeowner's policies. Flood damage can result from storm surges, heavy rainfall, or overflowing rivers and lakes. If you live in a high-risk flood zone or want to protect your home from any potential flooding, you should purchase a separate flood insurance policy.

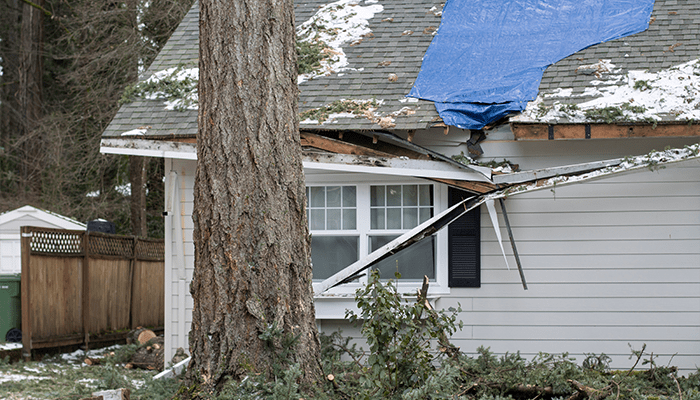

Another possible exclusion is windstorm damage, which some insurers may exclude or limit in coastal areas that are prone to hurricanes. Windstorm damage can include anything from broken windows and torn shingles to fallen trees and debris. If your homeowner's policy does not cover windstorm damage, you may need to buy a separate windstorm or hurricane insurance policy to fill the gap. Alternatively, you may have to pay a higher deductible for windstorm claims than for other types of claims.

In addition to these exclusions, you should also pay attention to the coverage limits and sublimit of your homeowners' policy. Coverage limits are the maximum amount that your insurer will pay for a covered loss, while sublimit are lower limits that apply to certain categories of property or causes of loss. For example, your homeowner's policy may have a sublimit for personal property damage caused by water or mold, which are common aftermaths of hurricanes. To ensure that you have enough coverage for your valuables and belongings, you should review your policy and consider buying additional coverage or endorsements if needed.

Tapping into Insurance Expertise

Our team is ready to help you navigate the insurance process if and when damage occurs. They can assist you with understanding your coverage, filing a claim, finding reputable contractors, and getting back to normal as soon as possible. When we asked for advice, here’s what they shared:

Cheryl Munguia, Personal Insurance Manager, experienced first-hand extensive damage to her home from hurricane Ida. Leveraging her industry knowledge and unfortunate experience with hurricane damage, she tells us, “You need to prepare and not take the weather for granted. Leave if you are told to evacuate and prepare early. Make sure to have your important insurance information available. Take note of your windstorm and hurricane deductibles, and the name of your insurance company. Take needed medication with you. Remember everything will close and take time to open if your area is impacted. Electricity will be off for a while and possibly your water and gas coming into home. Be prepared and have patience.”

Another AssuredPartners team member, Jennifer Singletary, Personal Insurance Risk Manager, understands challenges her clients experience when navigating claims. She suggests, “If you have minor damage don't call the insurance company right away and start a claim. Verify your deductible, talk to your agent, get estimates for repairs to know the value of the damage before the claim is filed. There are so many times claims are under the deductible and end up hindering the insured for claims activity when ultimately it could've been avoided.”

Our Florida teams have been through many hurricane seasons and know how to advocate for clients. “I always recommend that homeowners take a pre-storm video inventory of their home. So much goes on after a catastrophic loss and it’s difficult for any homeowner to recall everything they had in a room. Taking a walk-through video of each room in the home, as well as the exterior of the home, can be instrumental in assessing post-storm damage, providing inventory to a claims adjuster of damaged personal property and showcasing the adequate pre-storm condition of the home,” says Ayleen Brown, Director of Sales and Insurance Agent.

Still Have Questions?

Having the right insurance coverage can make a huge difference in how quickly and smoothly you can recover from a storm-related loss. At AssuredPartners, we are here to help you find the best options for your home and belongings, as well as guide you through the claims process if you need it. Contact us today and let us help you prepare for hurricane season with confidence and peace of mind.

Featured News & Insights

The holiday season can be stressful for many, as households feel pressure to visit family members, spend more than usual on gifts and join the hundreds of thousands traveling to their desired...

Wildfires are an ever-growing threat to communities across the globe, with their frequency and intensity increasing each year. The devastating impact of these uncontrolled blazes is felt not only in...

When it comes to natural disasters, storms producing wind and hail might not always grab the headlines like hurricanes or earthquakes, but they cause a surprising amount of damage and can lead to a...