The Dangers of Being Underinsured: Essential Tips for Homeowners

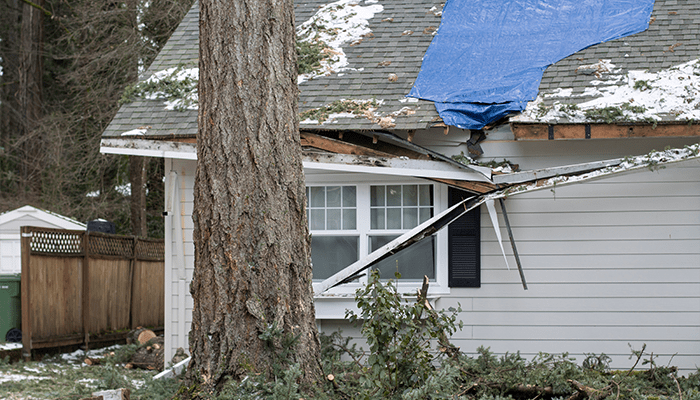

According to a report by LexisNexis Risk Solutions, only about half of homeowners understand the details about what’s covered in their policy. Most homeowners are unaware of their underinsurance status until disaster strikes. The serenity of a peaceful home can be shattered in an instant by natural disasters, leaving homeowners grappling with the reality of insufficient coverage. The aftermath often leaves homeowners questioning the quality of their insurance protection. We're here to help you join the homeowners who do understand their policy and navigate the risks of being underinsured.

What Isn’t Covered in My Homeowners Policy?

Natural Disaster Related Damages

Homeowners insurance policies often have exclusions that leave individuals exposed to certain risks. Typically, standard policies do not cover damages from natural disasters such as floods, earthquakes, and landslides, requiring separate insurance policies for these events.

Preventative Maintenance

In most cases, insurance is there to help when the unexpected happens. Wear and tear, neglect and maintenance-related issues are not covered, as the policy assumes homeowners will take reasonable care of their property.

High Valued Possessions

Personal property coverage often falls short of replacing all lost items, especially when homeowners underestimate the value of their possessions. Items of exceptionally high value, like fine art, jewelry and collectibles, may also need additional endorsements or separate policies to ensure adequate coverage.

Identifying Underinsurance

A good indicator of underinsurance is if the policy limit is significantly lower than the estimated cost to rebuild your home or replace your belongings. Regularly updating this estimate is key, especially after significant home improvements. It’s important to note inflation and changes in the housing market can affect the cost of rebuilding your home. A professional appraiser can perform a detailed assessment and provide an evaluation based on current construction costs and market conditions.

Take inventory of your personal possessions and estimate their value. Ensure your policy’s personal property coverage is sufficient to replace all items and consider additional endorsements for high-value items like jewelry, art, and antiques. Consulting with an insurance agent can provide valuable insights and help determine if additional coverage is necessary to bridge any gaps.

What are the Risks of Being Underinsured?

If your home is underinsured, you face significant financial risks in the event of damage or loss. Insufficient coverage could leave you responsible for a substantial portion of repair or rebuilding costs. This financial shortfall can strain your resources, potentially leading to debt or even the loss of your home. Underinsurance might not cover the full value of your personal belongings, meaning you would have to replace items out-of-pocket. Ensuring your insurance coverage is adequate is not just a precaution, it is a vital safeguard against unforeseen hardships.

Know Your Resources

Proper protection ensures that homeowners can quickly recover from unexpected events without suffering undue financial hardship. Regularly reviewing and updating insurance policies is essential to ensure that coverage keeps pace with rising repair costs, inflation and changes in home value.

To safeguard your home and financial well-being, we encourage you to find a local insurance agent who can review your policies at no cost. This proactive step will help you understand your coverage better, identify any gaps and ensure you and your family are fully protected against life's uncertainties. Don't wait for disaster to strike—act now to secure your peace of mind.

Featured News & Insights

The holiday season can be stressful for many, as households feel pressure to visit family members, spend more than usual on gifts and join the hundreds of thousands traveling to their desired...

Wildfires are an ever-growing threat to communities across the globe, with their frequency and intensity increasing each year. The devastating impact of these uncontrolled blazes is felt not only in...

When it comes to natural disasters, storms producing wind and hail might not always grab the headlines like hurricanes or earthquakes, but they cause a surprising amount of damage and can lead to a...