A Key Component to Consider When Signing a Franchise Agreement

Franchising is a great way for aspiring entrepreneurs to build a business using a familiar brand name without the challenges that come from starting a business from scratch. The aspiring business owner, also known as the franchisee, pays a fee to a franchisor for the use of the franchisor’s brand name, trademark, products and services as well as support and training to assist in selling their products or services.

The first step in the franchise process is signing a franchise agreement. A franchise agreement is a legal contract between a franchisor and franchisee that outlines each duty that the franchisor or franchisee owes to the other. The franchise agreement requires a franchisee to name the franchisor as an Additional Insured on their insurance policies to hold the franchisor harmless and indemnify the franchisor against claims, damages, losses or expenses incurred as a result of any and all claims. Having reviewed thousands of franchise agreements, we have found the name on the franchise agreement does not always match the name on the insurance policy. Many franchise owners sign the franchise agreement in their own personal name but later form a Corporation or LLC to do business as the franchise they purchased. This could lead to complications if they purchased insurance in the name of the Corporation or LLC.

The franchise agreement and the insurance policy are both legally binding contracts. If the named insured on the insurance policy does not match the name on the franchise agreement, the franchisor may lose the benefit of coverage on the franchisee's policy. Likewise, the franchisee, who has agreed to indemnify and hold the franchisor harmless, may have to pay or reimburse the franchisor or provide for its defense out of their own pocket.

It benefits both parties to amend the franchise agreement to reflect the business name under which the franchisee is doing business. Think about the importance of “what’s in a name” on the contracts you sign and the insurance you purchase to make sure you and your business are adequately protected. At AssuredPartners, we have a dedicated team of property and casualty professionals to provide consultation and strategic solutions to meet your diverse insurance needs. To learn more, visit AssuredPartners Property and Casualty Insurance.

Sources: Federal Trade Commission

Featured News & Insights

Wildfires are an ever-growing threat to communities across the globe, with their frequency and intensity increasing each year. The devastating impact of these uncontrolled blazes is felt not only in...

Wildfires are unplanned, uncontrolled fires caused by natural events like lightning or human activities like campfires and downed utility wires. These fires pose significant risks to businesses,...

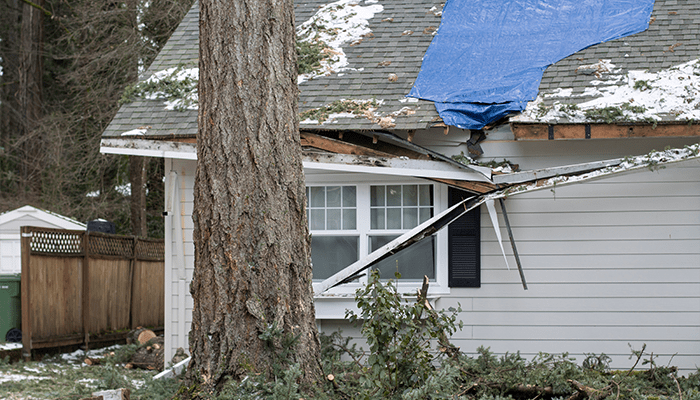

When it comes to natural disasters, storms producing wind and hail might not always grab the headlines like hurricanes or earthquakes, but they cause a surprising amount of damage and can lead to a...