Insurance Insights for the Hospitality Industry

Proactive risk management is essential for protecting your hotel property and business reputation. From assessing your business income requirements to ensuring proper subcontractor agreements, understanding your specific coverage needs is key. Hotels vary significantly in structure and services, which affects their risk profile. Here's a breakdown:

- Hotels with fewer amenities and typically lower occupancy rates often need access to excess and surplus lines due to specific risk factors, such as frame construction or exterior corridors.

- Business-class hotels tend to be more attractive to underwriters for their solid construction, sprinkler systems, and consistent amenities. For properties with franchise affiliations and high occupancy, our brokerage works to secure the most favorable terms possible.

- Resorts often feature high-value structures and amenities, from golf courses to water parks. Insuring these properties may require multi-layered coverage solutions in excess and surplus lines markets, particularly in high-risk, catastrophe-prone areas.

Hotels face numerous risks that standard commercial insurance policies may not adequately address. Here are some critical coverages to consider:

Ordinance and Law Coverage

Many hotels, particularly older properties, require ordinance and law coverage to ensure they can meet current building codes after damage. This coverage is vital for funding upgrades mandated by new codes during rebuilding. We carefully evaluate ordinance and law limits to ensure they include potential ADA compliance, sprinkler system installations, and other structural upgrades.

Business Income Insurance

This insurance protects hotels from revenue loss due to property damage and downtime during rebuilding. Many policies cover only actual loss sustained and may limit coverage to 12 months, which might not be sufficient for extensive rebuilds. We work with clients to customize business income coverage that aligns with realistic timelines and projected losses, providing peace of mind during disruptions.

Dependent Business Income Coverage

For hotels near key attractions or convention centers, dependent business income coverage is essential. This coverage supports revenue loss resulting from events that affect nearby attractions. For instance, if a neighboring convention center or theater experiences property damage that impacts your occupancy, this coverage is invaluable.

Comprehensive Liability Risk Management

Liability risk management is especially important in the hospitality sector. Our brokerage offers customized liability policies that address the unique exposures hotels face:

- Human Trafficking: Unfortunately, human trafficking poses a serious risk in the industry. We recommend developing human trafficking policies that include staff training to recognize warning signs.

- Liquor Liability: Hotels with bar or banquet services are exposed to liquor-related liability risks. Liquor liability coverage is essential, particularly for properties that serve alcohol as part of their offerings.

- Subcontractor Agreements: Hotels frequently rely on subcontractors, such as those for elevator maintenance and snow removal. Including proper risk transfer provisions in these agreements is important to protect against subcontractor-related liability claims. Our team assists hotels in establishing clear and effective subcontractor agreements that facilitate risk transfer.

Workers' Compensation and Ergonomic Risk Reduction

Workers' compensation remains a significant concern, especially for housekeeping and maintenance teams prone to ergonomic injuries. Collaborating with our risk management partners, we provide tools and ergonomic studies to help reduce repetitive strain injuries and streamline workers' compensation processes.

Cyber Liability Protection for Guest Data

Hotels routinely collect sensitive guest information through reservation systems and public Wi-Fi, making them vulnerable to cyber threats. Most franchise agreements now require minimum cyber liability coverage, though we recommend higher limits to cover potential breaches and data protection measures. Cyber liability insurance is essential for covering breach response costs and business interruption in case of a system hack.

Umbrella and Excess Liability

Due to tightening insurance markets, umbrella, and excess liability programs are becoming more selective. Several traditional excess programs for hospitality have reduced their coverage offerings, especially for high-risk properties. We diligently work to secure higher limits for our clients, carefully reviewing every option to meet franchise requirements and align with the client's unique coverage needs.

With so much at stake, having a partner who understands your industry helps to ensure your coverage matches your needs, market conditions, and compliance obligations. From helping you understand ordinance and law requirements to designing policies that protect your revenue streams, contact our hospitality team and discover the power of partnership.

Related articles

The commercial real estate insurance market is shifting, and if you’re managing risk for your properties, there’s a lot to keep an eye on. The good news? Property insurance rates are finally coming...

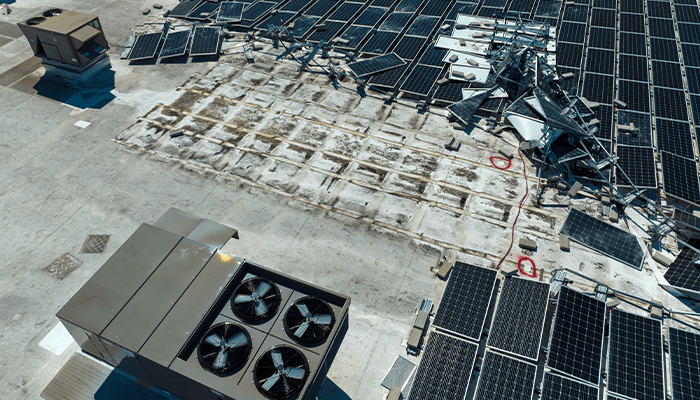

Because wind and hail damage can have significant impacts on commercial buildings, you need insurance professionals who understand commercial real estate to help advise you every step of the way....

Purchasing property is a significant financial commitment, often involving substantial upfront costs and long-term considerations. To protect your investment, it's important to conduct thorough due...