Preparing for Insurance Carrier Inspections

Loss control plays an essential role in managing commercial real estate risks, ensuring compliance and the protection of assets. In any business, especially real estate, preparing for insurance carrier inspections is a proactive way to mitigate potential risks and losses.

Understanding Loss Control in Commercial Real Estate

Loss control involves a series of risk management practices aimed at identifying potential risks and mitigating them to prevent claims. For commercial property owners and managers, this means being prepared for both expected and unexpected inspections by insurance carriers.

The goal of loss control is to assess risk exposures, develop strategies to mitigate them, and ensure proper safety measures are in place. This proactive approach helps improve the overall risk profile of the property and can influence favorable insurance terms.

The Inspection Process

Insurance carriers conduct loss control inspections to evaluate the quality of the risk and ensure adequate safety and risk management procedures are in place. For example, they may inspect fire protection systems, review safety policies, and evaluate building maintenance practices. These inspections often focus on key areas such as:

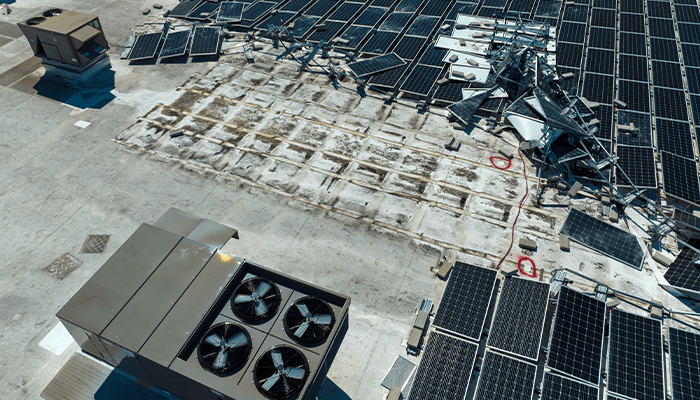

- Property condition: Assessing the physical state of the building, including maintenance schedules, fire suppression systems, and roof condition.

- Fire and life safety: Ensuring fire alarms, sprinkler systems, and emergency response plans are up to code.

- Management controls: Reviewing written safety policies, maintenance logs, and emergency procedures.

Preparing for a Loss Control Inspection

To prepare for these inspections, property owners and managers should request an inspection checklist from the insurance carrier. This checklist will provide a roadmap for what the carrier will be looking for, ensuring nothing is overlooked. Key preparation steps include:

- Ensuring that written safety programs, such as fire safety plans and maintenance logs, are up to date.

- Regularly testing fire protection systems, like sprinklers and smoke alarms, and keeping documentation available for review.

- Performing an internal review to help identify potential risks before the inspection, allowing time to correct any issues.

- Working closely with maintenance teams and external contractors to ensure everyone is aligned on safety standards and inspection preparation.

Addressing Loss Control Recommendations

Post-inspection, the insurance carrier may issue recommendations to improve safety and risk management. These recommendations typically fall into two categories: critical (mandatory) or advisory (best practices). Addressing these recommendations promptly is crucial, as failure to comply can result in policy cancellation or increased premiums. A proactive response helps maintain insurance coverage and improves the property’s risk profile, potentially leading to lower premiums over time.

As a commercial real estate insurance broker, we guide you through the loss control process, helping you understand what is required and how to respond to recommendations effectively. With the proper preparation, it’s possible to avoid potential hazards and secure more favorable insurance terms.

Featured News & Insights

The commercial real estate insurance market is shifting, and if you’re managing risk for your properties, there’s a lot to keep an eye on. The good news? Property insurance rates are finally coming...

Proactive risk management is essential for protecting your hotel property and business reputation. From assessing your business income requirements to ensuring proper subcontractor agreements,...

Because wind and hail damage can have significant impacts on commercial buildings, you need insurance professionals who understand commercial real estate to help advise you every step of the way....