First-Time Home Buyers Insurance Guide

Buying a home can be one of the largest purchases we make in our lifetime. As if the home buying process isn’t stressful enough, choosing the right insurance can be overwhelming or cause questions to arise. Ensuring our investment is properly protected is a must, so we put together a first-time home buyers' insurance guide to help you navigate the process:

Evaluate Insurance Costs

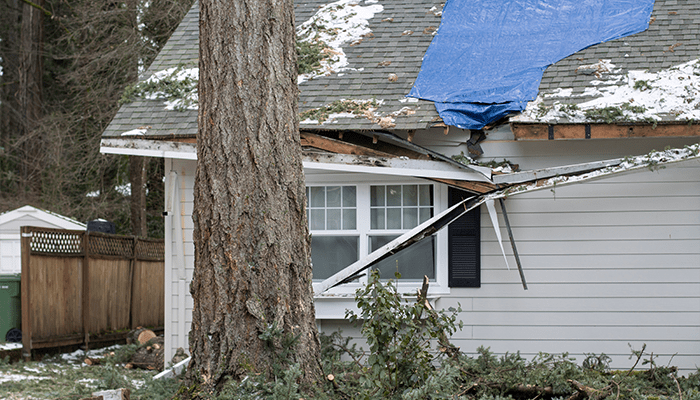

With inflation continuing to rise, the costs of building materials have skyrocketed, and the cost of labor continues to increase year over year, ultimately impacting insurance premiums. When we’re nearing the finish line of a home purchase and are presented with coverage packages to pick from, our first reaction is typically to go with the cheapest option. It’s important to understand that when it comes to insurance, saving money upfront may cost you more later. Selecting the cheapest option may cause financial hardships if and when disaster strikes. Depending on the carrier, cheaper insurance options may be due to minimum coverage levels or high deductibles.

If you’re concerned about the cost of your insurance plan, exploring ways to save is worth the time investment. Installing a security system in your home, paying your premiums in full rather than monthly, bundling your home insurance with auto coverage are great places to start. If you’d like additional support, tap into a local insurance agent for help.

Consider All Risks

While home insurance policies are likely to protect your home from accidental damage such as fire, lightning, windstorms and falling objects, there are other natural disasters that may not be covered. For example, standard home policies do not cover flood damage and a separate policy is often needed to insure your home against flood losses. With over 75% of Federal disasters related to flooding, this is deemed the most common natural disaster and as such, should be on your radar when selecting coverage.

Does your new home have a pool, a trampoline, or a dog? These can pose risks to you and those sharing your space. Home insurance typically covers damages from these types of accidents, but the cost can also exceed our policy limits, especially if someone has been hurt. If you feel you need extra coverage because you may have more than one of these risks in your new home, umbrella insurance can ease the worry about coverage limitation with current policies in place.

Weigh Your Coverage Options

It is likely your realtor will recommend an insurance agent to work with and while this is a viable option, this is not your only option. Getting a second opinion is a smart decision, this way you can see types of products available from different carriers, and a variety of pricing tiers associated with each.

Keep in mind, no person or family is the same. We live unique lives, in homes of all shapes and sizes, with varying budgets for our needs. There should never be a one size fits all insurance approach to buying coverage. What works for your neighbor or family member may not be the right fit for your lifestyle.

Ask Your Insurance Agent Questions

Knowledge is power, and it’s our job to educate our customers so they feel confident about their policies. Understanding what your current policy covers when buying a new home allows you to rest more easily, knowing what you can do to ensure you’re protected. The more you know about your policy, the better you’ll feel about addressing coverage. We empower you to take control of your insurance decisions. If you’d like us to shop for insurance on your behalf, we invite you to get a quote and we’ll be in touch.

Featured News & Insights

The holiday season can be stressful for many, as households feel pressure to visit family members, spend more than usual on gifts and join the hundreds of thousands traveling to their desired...

Wildfires are an ever-growing threat to communities across the globe, with their frequency and intensity increasing each year. The devastating impact of these uncontrolled blazes is felt not only in...

When it comes to natural disasters, storms producing wind and hail might not always grab the headlines like hurricanes or earthquakes, but they cause a surprising amount of damage and can lead to a...