Unlocking the Hidden Value of R&D for Manufacturers: A Guide to Tax Credits and Capitalization Challenges

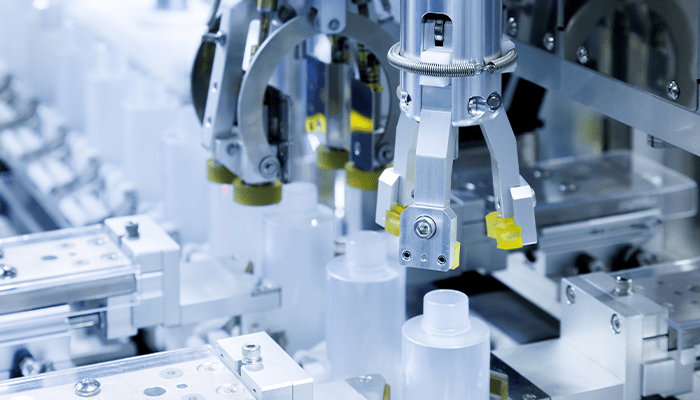

Innovation is essential for manufacturers – companies must continue to evolve through new product development, production improvement processes, or integrating cutting-edge technologies like automation and artificial intelligence. However, the costs associated with research and development (R&D) can be overwhelming. Fortunately, there are opportunities available to ease this burden and reward innovation.

Our recent webinar explored two critical aspects every manufacturer should consider: R&D tax credits and the impact of the new R&D capitalization rule. Here's a breakdown of what manufacturers need to know to take advantage of these opportunities while managing potential challenges.

What Are R&D Tax Credits?

R&D tax credits are a powerful financial tool that allows manufacturers to reclaim a portion of the money spent on qualifying research and development activities. This isn't limited to groundbreaking innovations. Many routine activities you're already doing, such as process improvements, product testing, and developing software to optimize your production, may qualify.

What Qualifies as R&D?

A common misconception is that R&D only applies to creating revolutionary products. However, the IRS uses a broad definition that could apply to many activities in your operation. For an activity to qualify, it must meet the four-part test:

- Permitted Purpose: Activities must improve or develop a product's performance, functionality, quality, or reliability.

- Technological in Nature: Activities should rely on hard sciences like engineering or computer science.

- Eliminating Technical Uncertainty: You must attempt to eliminate uncertainty around product capability or design.

- Process of Experimentation: There should be a process involving testing and trial and error.

Examples of qualifying activities include everything from creating prototypes to improving manufacturing processes or developing internal software for automation.

Maximizing Your R&D Tax Credit

The R&D tax credit allows manufacturers to recover 5-10% of their qualifying R&D expenses, which include wages for employees involved in R&D, the cost of materials used in development, and even contract research. The credit can provide substantial cash savings and is available annually, meaning you can continually benefit from it as your company grows and innovates.

Additionally, even if your business didn't claim R&D credits in prior years, it's possible to retroactively apply for credits going back three years by filing amended returns.

The New Challenge: R&D Capitalization Rule

While the R&D tax credit offers significant benefits, the new capitalization rule introduced in 2022 complicates things. Under this rule, manufacturers can no longer fully deduct R&D expenses in the year incurred. Instead, these costs must be capitalized and amortized over five years for domestic research and 15 years for international R&D.

This change was part of the 2017 Tax Cuts and Jobs Act, intended to raise revenue to offset tax cuts. While there was hope that Congress would repeal this rule, it remains in effect, meaning manufacturers need to be proactive in managing its financial impact.

For example, if you spend $1 million on R&D in a given year, under the capitalization rule, only $100,000 of that can be deducted in the first year, with the remaining amount spread out over the following years. This delay in deducting R&D expenses can significantly increase your tax liability in the early years, especially for manufacturers investing heavily in innovation.

Navigating the Good, the Bad, and the Ugly

The good news is the R&D tax credit remains a valuable incentive for manufacturers to continue investing in innovation. The bad news is the added burden of capitalizing and amortizing these expenses, which can negatively affect your tax bill in the short term. The ugly aspect is managing the financial hit in the early years before the full amortization of expenses kicks in.

For many manufacturers, this rule presents a new tax burden that can complicate financial planning. However, by working closely with tax professionals and adjusting your R&D strategy, you can minimize the negative impact while continuing to claim valuable credits.

Take Advantage of R&D Credits Despite the Challenges

Despite the new capitalization rule, the R&D tax credit remains one of the best ways for manufacturers to reduce their tax burden while continuing to innovate. With careful planning, manufacturers can offset some of the financial strain caused by the new rule and continue to invest in the future.

If your company is involved in R&D activities or you're unsure if you qualify, it's essential to contact a tax expert specializing in R&D credits. With the right guidance, you can unlock the hidden value in your innovation efforts, lower your tax burden, and stay competitive.

Featured News & Insights

The manufacturing industry is changing fast. With record-breaking investments in new facilities, cutting-edge technology, and a push for smarter, more sustainable operations, there’s a lot to be...

Manufacturing is a cornerstone of the global economy, encompassing industries that transform raw materials into finished goods. From automotive and aerospace to electronics and consumer products, the...

A recent Forbes story on key topics for manufacturers going into 2025 mentioned several, but the overall theme was the advancement of AI technologies in the manufacturing industry. Following is a...