Why the Type and Condition of Your Roof is So Important

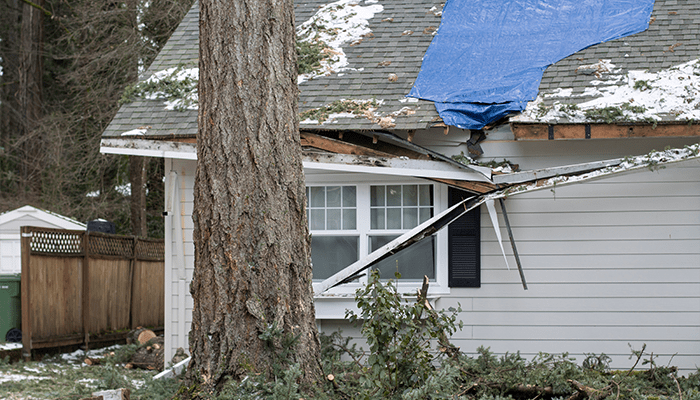

Homeowner insurers are increasingly taking steps to address their high loss ratios associated with stronger and more frequent storms, particularly in the Midwest. As a result, insurance agents are asking more detailed and seemingly intrusive questions about your roof covering, requesting documentation to prove your answer and even a drone inspection over your home.

Special roof deductibles, new roof loss settlement provisions and premium surcharges and credits are more commonplace now than ever before depending on roof type and age. Some examples include:

- 1-2% of dwelling amount deductibles on roofs over 15 years old of any type and on wood shake, flat or tile/slate roofs of any age

- No more cash pay-out for total roof replacements – insurers will only pay full replacement cost if the job is actually contracted and the roof replaced

- Cosmetic damage to metal roof surfaces that does not affect the actual integrity of the roof may no longer be covered

- Following a total roof loss, funds may be provided by the insurance company to “upgrade” roof coverings to hail resistant

- New roofs with proof of same may receive substantial premium credits

Homeowners are wise to have their roofs inspected every year, and particularly after hail storms hit their neighborhood. AssuredPartners Personal Insurance agents help by making you aware of proactive loss prevention and claims services that can make your roof risk healthy and attractive to the best insurance company partners, resulting in protection and favorable rates. To learn more, visit AssuredPartners Personal Insurance.

Featured News & Insights

The holiday season can be stressful for many, as households feel pressure to visit family members, spend more than usual on gifts and join the hundreds of thousands traveling to their desired...

Wildfires are an ever-growing threat to communities across the globe, with their frequency and intensity increasing each year. The devastating impact of these uncontrolled blazes is felt not only in...

When it comes to natural disasters, storms producing wind and hail might not always grab the headlines like hurricanes or earthquakes, but they cause a surprising amount of damage and can lead to a...