Cruise with Confidence: Save on Classic Car Insurance with a Broker

If you're looking for classic car insurance, you may want to consider working with an insurance broker. An insurance broker acts as an intermediary between you and the insurance companies. They help you find the best coverage options for your specific needs, compare quotes from different insurers and negotiate available rates and discounts for you. A broker can also assist you with filing claims, renewing your policy, or making any changes to your coverage. At AssuredPartners, we’re driven to be a great partner for you and your valuables.

Choosing a broker has many benefits, including personalized service and advice from someone who understands your situation and preferences. A broker also allows you to save time and hassle by doing research and quote paperwork for you. Often you have more options since you gain access to a wider range of insurance products and providers than if you shopped on your own. You can also find lower premiums or better coverage than what's available online or through direct channels. Ultimately, a broker serves as an advocate who can represent your interests and help you resolve any issues or disputes with the insurer.

To find a reputable and qualified broker, you can ask for referrals from friends, family, or other classic car owners, check online reviews and ratings, or contact your local insurance association. Make sure you choose a broker who specializes in classic car insurance, has a valid license and credentials, and discloses their fees and commissions upfront. You should also feel comfortable and confident with their communication style, professionalism, and expertise.

How Does Classic Car Insurance Coverage Work?

Unlike regular car insurance, classic car insurance considers the unique characteristics and value of your car, which may not be accurately reflected by its market price or depreciation. Classic car insurance typically offers lower premiums, agreed value coverage, and flexible usage limits than standard car insurance policies. Review our checklist below to see if you qualify for collector car insurance.

What are the Benefits?

Classic car insurance can help you protect your valuable investment and enjoy your passion for classic vehicles. By working with a broker, you can find the best classic car insurance policy that suits your needs and budget. If you meet the requirements mentioned above, you can enjoy the benefits of classic car insurance, such as agreed value coverage, which means that you and the insurer agree on the value of your car at the start of the policy and that's what you'll get paid in case of a total loss. This prevents any disputes or surprises about the payout amount and protects you from depreciation or fluctuations in the market value of your car.

Collector car insurance typically offers lower premiums, which reflects the lower risk and usage of your car. You may also qualify for discounts if you belong to a car club or have multiple policies with the same insurer. Flexible usage limits allow you to choose how much you want to drive your car for personal or recreational purposes. Some insurers may offer unlimited mileage or no restrictions on when you can drive your car, if you follow the agreed usage terms.

Many options include roadside assistance, which provides towing, battery jumpstart, flat tire change, or fuel delivery services if your car breaks down or runs out of gas. Some may also cover the cost of transporting your car to a repair shop or a car show. Another benefit includes spare parts coverage which covers the cost of repairing or replacing any spare parts or accessories that are damaged or stolen from your car such as wheels, tires, radios, or tools.

Cruise With Confidence

As you can see, classic car insurance offers many advantages and features that can help you safeguard your prized possession and enjoy it to the fullest. Whether you own a muscle car, a classic truck, or a classic sports car, you deserve to have the right coverage for your unique needs. That's why working with a broker can make a big difference in finding the best policy for you and your car. At AssuredPartners, we have the experience and expertise to help you navigate the classic car insurance market and find the best options for your budget and preferences. Contact us today for a free quote and let us help you cruise with confidence.

Featured News & Insights

The holiday season can be stressful for many, as households feel pressure to visit family members, spend more than usual on gifts and join the hundreds of thousands traveling to their desired...

Wildfires are an ever-growing threat to communities across the globe, with their frequency and intensity increasing each year. The devastating impact of these uncontrolled blazes is felt not only in...

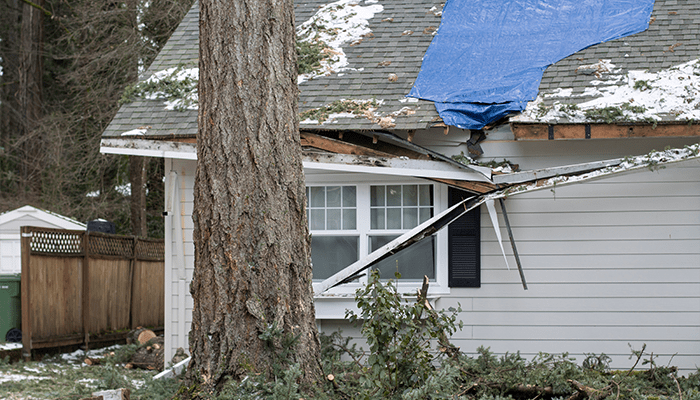

When it comes to natural disasters, storms producing wind and hail might not always grab the headlines like hurricanes or earthquakes, but they cause a surprising amount of damage and can lead to a...