Addressing Insurance Coverage Gaps in the Face of Active Assailant Events

Insurance buyers have traditionally focused on how to protect their company from unintended events that can lead to property damage, financial losses, injuries, or even death. Over the last few years, deadly active assailant events have become a new area of concern.

Real estate owners are especially vulnerable to active assailant events. They are now tasked with identifying the best policies and practices to safeguard their employees and the individuals their organization serves.

Insurance coverage for these events presents several complexities. Traditional terrorism policies typically cover acts of terrorism that target specific buildings or locations and require property damage for coverage to apply. The standard terrorism policy also requires that the motive be ideological, political, or religious in nature. From a general liability perspective, active assailant events do not always fit the definition of "accident" to trigger coverage, as these events could have personal or ambiguous motives.

Furthermore, general liability coverage was not designed to cover preventive costs or provide immediate assistance after an event. General liability coverage requires a written demand or a claim. After an active assailant event, no one wants to wait on the claim. Companies want to reach out and start helping the victims and the community to recover without lawsuits.

Workers' compensation policies in most states only cover employees for injury or death from a shooting if it is not personal and is related to the work. A domestic violence situation would not be covered. If the active assailant issue were deemed not work-related, there would also be no coverage for dependents or beneficiaries who might bring action against the organization.

These gaps in terrorism, general liability, and workers' compensation coverage have encouraged insurers to create traditional named-perils coverage for this risk category. These policies, referred to by various names like active shooter, workplace violence, active assailant, or deadly weapons protection, provide similar coverage. They typically include five fundamental components:

- Prevention Service: Evaluation of the security protocols and action plans, including incident awareness and response to an incident.

- Crisis Management: Counselling and communication strategies, temporary security enhancement (e.g., armed or unarmed security guards), public relations, media management, and funeral expenses.

- Indemnity for Losses: Primary coverage for lawsuits arising from harm caused by attacks, accidental death and dismemberment coverage, medical payments, as well as coverage against the threat of a deadly weapon attack.

- Business Income and Extra Expense: These events are expensive, and this coverage can help business owners stay in business. Many organizations close for weeks, even months, after an active assailant event.

- Property Coverage: Primary physical damage caused by the event. Includes mental anguish, demolition, clearance, and memorialization costs, ingress/egress, and prevention of access by civil/military authorities, as well as extra expense to resume operations. Traditional property policies only pay for repairs or replacements. Some property becomes unusable because of mental anguish (e.g., Sandy Hook) or the organization wants to tear down and rebuild, refurbish, or restore the inside to a much greater extent than the repairs required.

For real estate owners and business leaders, a proactive approach is crucial to protect your employees and organization from the growing threat of active assailant events. Review your current insurance policies, identify potential coverage gaps that may expose you to financial losses and lawsuits, and consult with your insurance provider to understand the active assailant coverage options available to ensure appropriate protection.

Featured News & Insights

The commercial real estate insurance market is shifting, and if you’re managing risk for your properties, there’s a lot to keep an eye on. The good news? Property insurance rates are finally coming...

Proactive risk management is essential for protecting your hotel property and business reputation. From assessing your business income requirements to ensuring proper subcontractor agreements,...

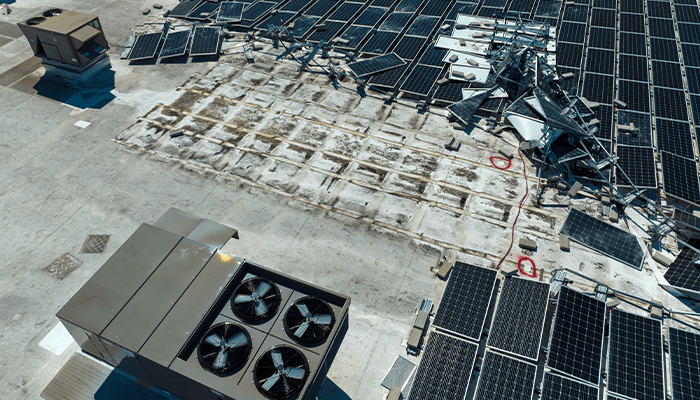

Because wind and hail damage can have significant impacts on commercial buildings, you need insurance professionals who understand commercial real estate to help advise you every step of the way....