Protecting yourself and your valuables

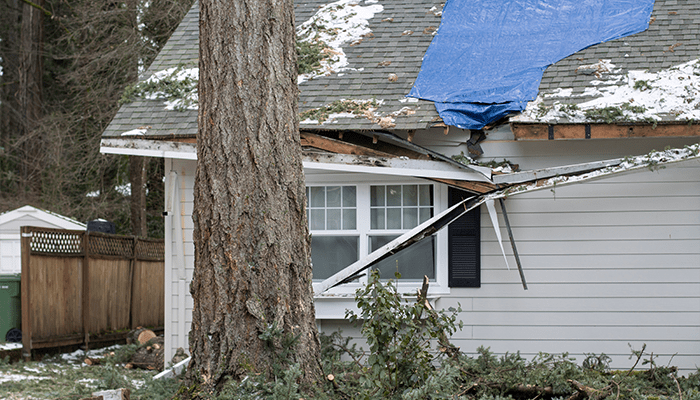

A renters insurance policy will protect your personal property and provide liability coverage in the event someone is injured inside of the rental unit. Having coverage that reimburses for living expenses is crucial in the event of your apartment or rented home is destroyed.

Let's ensure you and your belongings are properly protected:

Is my landlord or management company responsible for coverage?

Your landlord or management company may be responsible for the building you live in, but they are not held accountable for your personal contents inside the rental property or damage you may cause to the property.

A renters insurance policy will protect your valuables and provide liability coverage in the event someone is injured inside of, or you damage, the rental unit. Covered claims include medical expenses in the event your pet bites a visitor, theft, and fire.

Stay protected with AssuredPartners

AssuredPartners provides competitive renters insurance solutions in addition to a full spectrum of personal insurance products designed to meet your unique needs.

Featured News & Insights

The holiday season can be stressful for many, as households feel pressure to visit family members, spend more than usual on gifts and join the hundreds of thousands traveling to their desired...

Wildfires are an ever-growing threat to communities across the globe, with their frequency and intensity increasing each year. The devastating impact of these uncontrolled blazes is felt not only in...

When it comes to natural disasters, storms producing wind and hail might not always grab the headlines like hurricanes or earthquakes, but they cause a surprising amount of damage and can lead to a...